Importance of an Emergency Fund

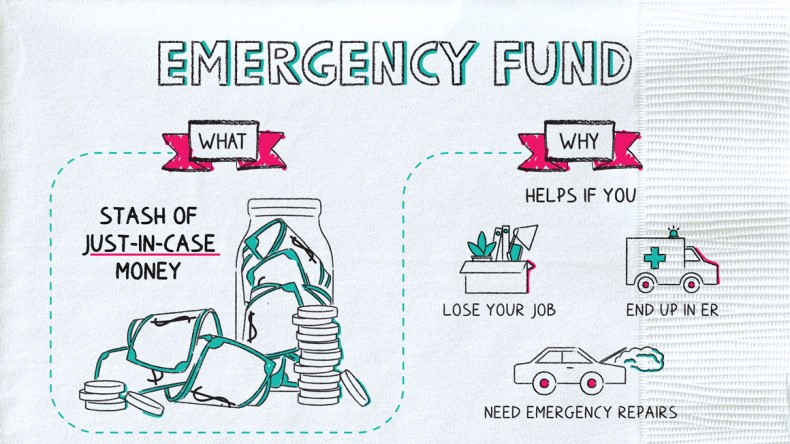

Emergency Funds: You should have an emergency fund set aside in case of an emergency. If you need to access this fund in an emergency or unexpected circumstance, you shouldn’t use it to meet your routine expenses. To meet any unanticipated shortfalls you may experience, it must be designed specifically for your purposes.

Liquidity in Emergency Fund

It is critical that your emergency fund is liquid to enable you to cover unexpected expenses, and for that reason, it should be parked somewhere that is easily accessible. It should be possible to withdraw the money whenever you need it and without any delays. At the same time, you need to be careful not to receive a pre-withdrawal penalty or exit load. A reasonable return on investment must not decrease either, and investments must not go down in value.

How to Build an Emergency Fund

The process of building an fund takes time and requires patience. A particular amount should be deposited into a separate account every month. You will soon have an extensive collection of documents that you want. If you decide to have an Rs.1 lakh emergency fund, include this in your budget. Depending on the amount, you can set aside Rs.5,000 or Rs.10,000 every month to accumulate the corpus. This amount can even be built by reducing your investments.

How big should your Emergency Fund be?

Three to six months of your monthly income can be the amount you put toward an emergency fund according to your income and expenses. You will want to save somewhere between Rs.60,000 and Rs.1,000,000 if, for example, you earn Rs.30,000 a month and Rs.15,000 of that goes towards your routine living expenses.

It is possible that you have two types of funds for emergencies.

Long-term emergency funds

The emergency fund is used in large-scale emergencies like natural disasters. In order to get higher interest rates, this fund should be invested in instruments that may take a couple of days to liquidate, but offer higher interest rates.

Short-term emergency funds

During times of crisis, you turn to this fund. In an emergency situation, a fund like this should not offer much interest but make its funds immediately accessible, which may suffice to tide you over until your long-term funds are available.

How and where to invest your Emergency Fund?

The emergency fund you have built up shouldn’t be entirely stored in cash or a bank account once you have accumulated it. It’s not something you should access often, even though it should be liquid.

Check out: Flipkart Big Billion Days 2021: Best Offers and everything you know!

So, if you are investing it, make sure that you earn reasonable returns without compromising on liquidity. It would be ideal to spread out the emergency fund among liquid funds, money market mutual funds, and short-term repurchase agreements.

Example:

We will assume that you have accumulated your fund of Rs.1 lakh. Instead of keeping cash at home, you could invest the remaining 60,000 rupees in a liquid mutual fund and let the remaining 20,000 rupees remain in your savings account.

Note on Liquid Funds!

A liquid fund invests in debt instruments that mature within 91 days, making it a class of debt funds. Unlike debt instruments whose interest rates are affected by interest rates, these debt instruments are highly rated. This makes them reasonable without being volatile. A liquid fund has earned up to 8% in returns over the past few years. Compared with savings or fixed deposit accounts, these are higher returns. The liquid fund may even benefit you with indexation when you eventually redeem it if you do not need this emergency fund for more than three years.

Redemption of emergency funds

Many liquid funds let you redeem a portion of the investment amount immediately or up to Rs.50,000. Redeeming is possible whenever you like. Your bank account will be credited instantly with the money. Make sure that the fund house allows immediate redemptions before investing in liquid funds. You will be able to ensure quick access to your emergency fund while also reaping high returns if you spread it across a variety of different avenues.

Simply put, prepare yourself for tomorrow’s unknowns. So this was our guide on how to prepare a Fund for yourself during emergencies and how to go about it.